- Automotive industry generated the largest demand for production spaces throughout Romania, in the last 10 years

- Bucharest, the most developed industrial & logistics region

CBRE, the global and national leader in commercial real estate services and investments, launched „Manufacturing Report 2023” which shows that the production spaces are on an upward trend. According to CBRE data, in H1 2023, the requests for production spaces started to represent circa 25% of the transactional activity in Romania.

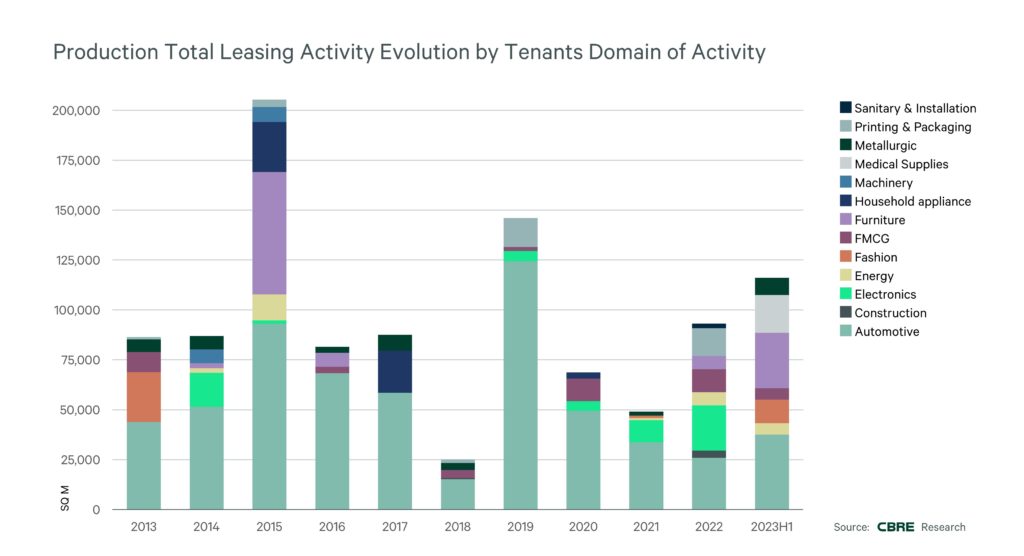

The automotive industry is the leader in the demand rais, generating the largest demand for production spaces throughout the country in 2013 – H1 2023 period, meaning 56%. At a considerable distance, this industry is followed by Furniture and Electronics fields of activity with shares of 10% and 6% of the total leased area for production purposes.

„In the last ten years, the annual new industrial supply was on an ascending trend, from 2018 onwards even representing close to or more than half a million sq m per year, a timeline of deliveries that pushed the country’s modern industrial stock to swiftly overpass development milestones. Automotive companies have consistently been the most active players in the Romanian industrial market, followed by sectors such as furniture, electronics, household appliances, and FMCG. Romania’s industrial market is thriving, with a potential for future growth further supported by factors such as favorable location, access to road and railway infrastructure, and upcoming state aid schemes.”, stated Daniela Gavril, Head of Research, CBRE Romania.

According to „Manufacturing Report 2023”, in the last 10 years, besides the local producers, the manufacturers that chose Romania for a production facility are mainly from Europe and the USA. The top five countries of origin of the market players, considering the largest leased production area during the analysed period, are Germany, Italy, Romania, the USA, and France.

- The West / North West industrial region, the country’s magnet for manufacturers

At the same time, total leasing activity for ten and a half years’ time indicates the West / North West industrial region as the country’s magnet for companies in need of leasing a production space. The South region is next on the list of logistics players. The two industrial sub-markets together claim from half up to entire (in 2017) leasing activity in the 2013 – H1 2023 period. At the opposite end, the East / North East part of the country accommodates the lowest percentage of the leased area, with one exception in 2013 when it represented 14% of the leased surface concluded for production.

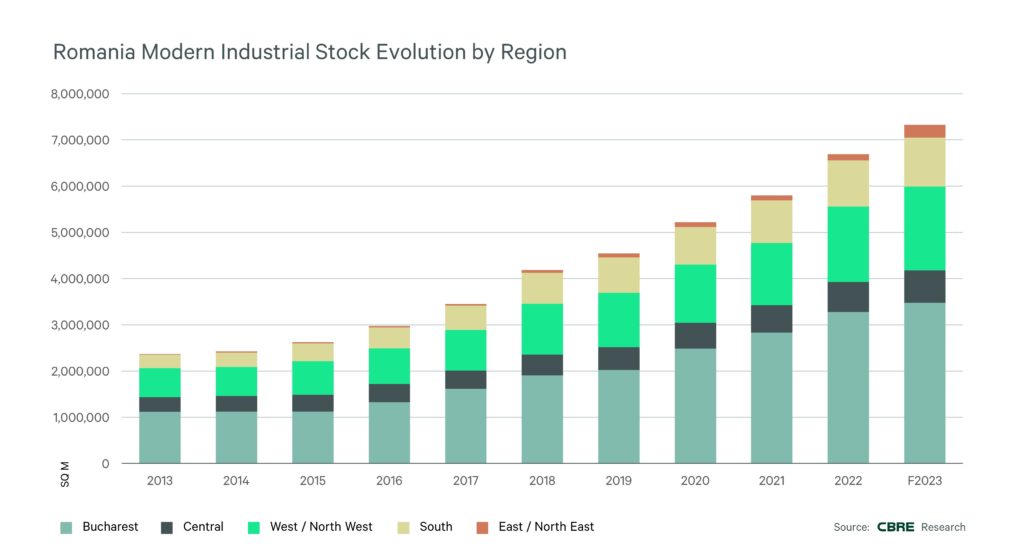

Bucharest remains the most developed industrial & logistic region within the country. It is the only market that was further broken down into eight sub-markets. Alongside the almost 50% share of the capital city within the country’s modern stock, at the end of the first half of 2023, the West / North West region is the second most developed with a quarter of the total leasable area, followed by the South, Central, and East / North East regions.

„Recent historical events have shaped the real estate market as well as players’ needs and behaviours. Based on the Romanian industrial and logistics market insights we gathered in ten and a half years’ time and on trends we have seen lately on the market we launch this complex market study for a larger and more complex landscape. All our data indicates that Romania can still be considered to have hidden gems for production developments, taking into account land availability and limited competition. As the market evolves, addressing environmental, social, and governance (ESG) impacts will also play a crucial role in maintaining sustainability and community acceptance”, added Elena Șerban, Senior Research Analyst, CBRE Romania.

The industrial market in Romania has experienced significant growth over the past ten years, with a substantial increase in supply and demand. According to the latest data, the new supply of industrial stock has more than doubled compared to what would have been considered modern stock a decade ago.

The great synergy created by industrial and retail players, and the boom of e-commerce, contributed to the increase of demand for such spaces.

One of the main factors that must be taken into account in the current context is ESG. The importance of addressing the ESG impact cannot be overlooked, whether it involves developing new spaces or retrofitting existing ones. The pressure for compliance is becoming increasingly forceful, emanating not only from regulatory authorities but also from the local community.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm (based on 2022 revenue). The company has approximately 115,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. In Romania, CBRE serves a diverse range of clients with an integrated suite of services including transaction management and coordination, project management, design and build services, property management, investment management, valuation, property rental, strategic consulting, property sales, mortgage services, and development services.

acum 1 an

245

acum 1 an

245

English (US) ·

English (US) ·  Romanian (RO) ·

Romanian (RO) ·